Mumbai: Even as India is making significant strides in enhancing ‘access’ to banking and financial services, there is still considerable ground to cover in deepening financial inclusion which could be achieved by greater focus on promoting ‘usage’ and improving the ‘quality’ of services, the Reserve Bank of India (RBI) Deputy Governor Swaminathan J said on Wednesday. He said that in both these critical areas, the role of Lead District Managers from the banks and District Development Managers from NABARD was indispensable. Lead District Manager is a role assigned to a bank official in a district under the Lead bank scheme of the RBI.

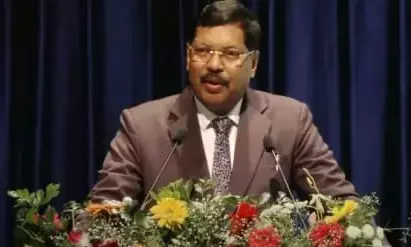

Speaking at a conference of Lead District Managers and District Development Managers in Hubballi, Karnataka, Swaminathan said that if local representatives know their districts well, they could leverage upon data analytics and field surveys to gain insights into economic activities, local credit needs, and barriers to credit access.

The central bankers rued the fact that although credit delivery to priority sectors has progressed over time, there is still significant work to be done especially with regard to Micro, Small and Medium Enterprises. Similarly, nearly half of Self-Help Groups (SHGs) are yet to be linked to formal credit, and a large proportion of small and

marginal farmers still lack access to bank financing. “Therefore, we must factor in the credit requirements of these segments in potential linked credit plans as well as in block and district-level credit strategies.” He also asked bankers to increase female labour participation in MSMEs as less than 20 per cent of MSMEs are owned by women.