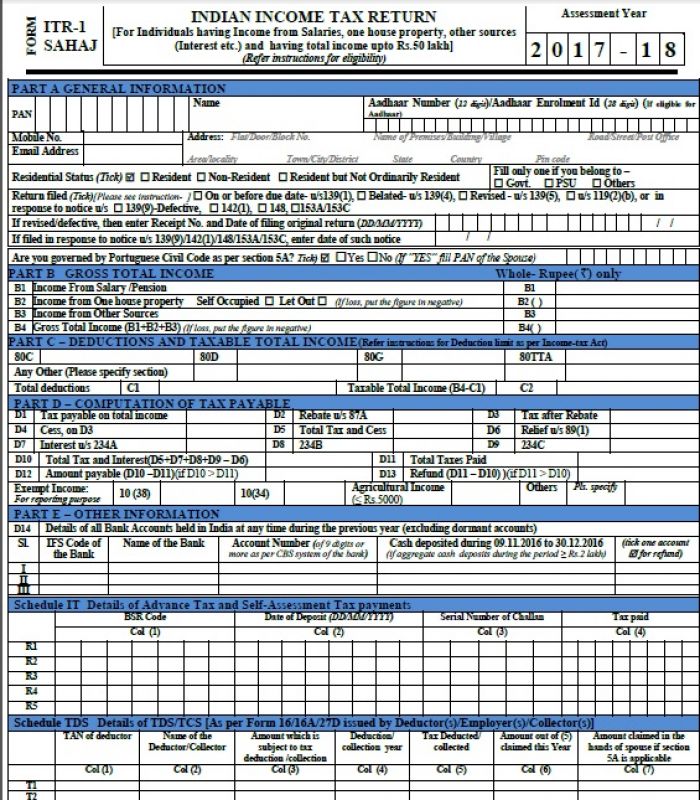

Filing I-T returns: a step-by-step guide to fill ITR-1 Sahaj form

ITR-1 Sahaj form is a simple, seven-structure form for individuals earning up to Rs 50 lakh.

Mumbai: The new 'ITR-1 ‘Sahaj’ form is out for filing income tax returns and is a simplified return form for the salaried class with an income of up to Rs 50 lakh only.

The ITR-1 Sahaj form is a one-page form that apart from concerning salaried individuals, also concerns those earning income from One House Property or from other sources.

The ITR-1 Sahaj Form has seven main parts highlighted in blue rows.

The ITR-1 Sahaj Form has seven main parts highlighted in blue rows.

The Sahaj form is divided into five basic parts. This is a step-by-step guide on how to fill the same:

Part A: General Information

This part basically assembles all your personal information and helps in communication with the I-T department. It requires you to carefully fill in your Permanent Account Number (PAN), your 12-digit Aadhaar number or Aadhaar enrolment number in case the former has not been received and your own mobile number email ID. It also asks for your communication address, what kind of service you belong to – government, PSU or others, when and how the return has been filed.

Part B: Gross Total Income

This part requires you to disclose your income in a specific manner under four heads:

B1: For those who receive their income from salary /pension

B2: For those who receive their income from one house property (whether self occupied or let out)

B3: For those who receive their income other sources

B4: Mention the gross total income (B1+B2+B3)

Part C: Deductions and Taxable Total Income

This part lists the deductions you can claim form your total salary. It consists of the following deductions-

80C: Amount paid or deposited for life insurance, Provident Fund, approved superannuation fund, subscription to National Savings Certificates, children’s tuition fees, payment for purchase or construction of a residential house and other investments listed under 80C of Income-Tax Act. The total shall not exceed one lakh and fifty thousand rupees.

80D: Amount paid for medical insurance premium, contributions to CGHS and medical expenditure incurred. The upper limit for medical expenditure of the following is given here-

a)Health insurance premium

1. Self , Spouse, Dependent Children (aggregate)- Rs 25,000

2. Parents- Rs 25,000

3. Senior Citizen or very Senior Citizen- Rs 30,000

4. Premium paid by HUF for health insurance of any member of HUF- Rs 25,000

b) Medical expenditure in the case of a very senior citizen (above 80 years) where no amount has been paid for his health insurance

1. On self- Rs 30,000

2. On parents- Rs 30,000

3. On member of HUF paid by HUF- Rs 30,000

For preventive health check-up of self or family members or parents- Rs 5,000/- within the limit of Rs 25,000/- or Rs 30,000/- as the case may be.

80G: Amount paid for donations to certain funds, charitable institutions, etc.

80TTA: Amount paid as interest on deposits in savings account with deposit up to Rs 10,000.

In case you want to claim any other deductions apart from the ones listed above, mention it along with the section in the fifth column ‘for others’.

In the end calculate your Total Deductions (C1). The Total Taxable Income (C2) is calculated like this –

C2 = Total Income (B4) – Total Deductions (C1)

Part D: Computation of Tax Payable

This part deals with calculating the total tax on your total taxable income (C2) that is computed after deductions from part C. Rebate is claimed under sec 87A up to a maximum amount of Rs 5,000 if the total salary does not exceed Rs 5 lakh. Relief can be claimed under sec 89(1) from the tax payable amount if any advance/arrears of salary is received during the year. Also you should give details of all your exempted income — dividend income, agricultural income, and LTCG etc.

Part E: Other Information

This part requires the details of all the savings and current accounts held by you at any time during the previous year. However, details of dormant accounts is not mandatory.

You should indicate the account in which you would like to receive your refund. The account number should be as per Core Banking Solution (CBS) system of the bank. The amount of cash deposited during the previous year in that account- 09.11.2016 to 30.12.2016, should also be filled.

In case cash is deposited during 09.11.2016 to 30.12.2016 in any account other than the current and savings account (viz. loan accounts etc.), then details of such account indicating the cash deposited in the said account during the said period should also be provided.

It may be noted that details of cash deposited are to be provided, if the aggregate amount of cash deposited during 09.11.2016 to 30.12.2016 is Rs.2 lakh or more.

Schedule IT Details of Advance Tax and Self-Assessment Tax payments

You are required to fill details of tax payments, i.e., advance tax and self-assessment tax made by you. Fill the BSR code, the date of deposit and serial number of challan tax paid.

Schedule TDS Details of TDS/TCS [As per Form 16/16A/27D issued by Deductor(s)/Employer(s)/Collector(s)]

Furnish complete details of every TDS/TCS transaction deducted on your income in accordance with Form 16 issued by your employer and Form 16A issued by a person in respect of interest income and other sources of income. Also, details of TCS in accordance with Form 27D issued by the tax collector should be mentioned.