Guide to linking Aadhaar with PAN

The linking of Aadhaar and PAN will be useful for E-Verification of Income Tax returns using Aadhaar OTP.

New Delhi: Come July 1, linking of Aadhaar will become mandatory for filing income tax returns, as enshrined in the Finance Act, 2017. The Income Tax (I-T) department has been rallying its efforts to encourage tax payers to link their PAN or permanent account number with Aadhaar. An email from the I-T department’s e-filing team said: “This (linking of Aadhaar and PAN) will be useful for E-Verification of Income Tax returns using Aadhaar OTP (One-Time Password)”.

Aadhaar is issued by the UIDAI or Unique Identification Authority of India to residents, PAN is a ten-digit alphanumeric number issued in the form of a card by the I-T department to a person, firm or entity.

While the many tax payers have been receiving emails on how to link their PAN with Aadhaar online, advertisements in various newspapers describe how it can be done via SMS. But before tax payers go on to do so, here are a few things to know:

PAN-Aadhaar linking online

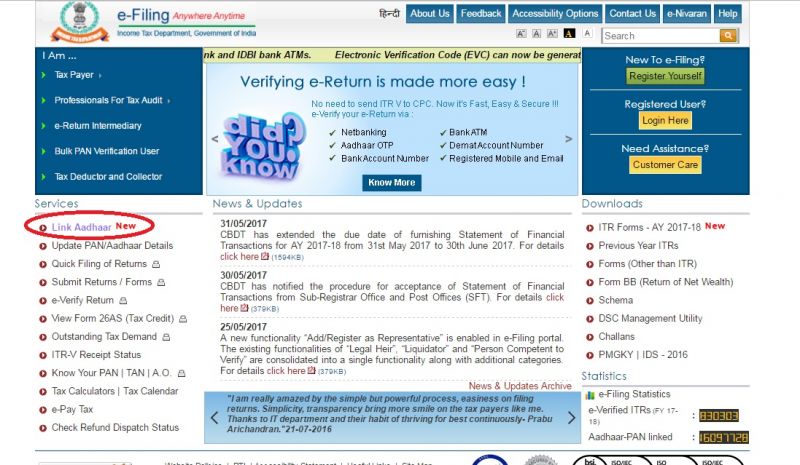

incometaxindiaefiling.gov.in

The I-T department’s website has been flashing this new link on its homepage to set up PAN with Aadhaar. The I-T department’s email from its e-filing team says a new feature available on the website does not require the user to register or login. This feature can be used by anyone to link their Aadhaar with PAN.

How to do it

Once an assessee is on the I-T Department's e-filing website, he or she needs to click on the new 'Link Aadhaar' option visible on the left hand side, just below the blue “I Am..” box.

The person is then required to provide PAN, Aadhaar No. and name (as is exactly mentioned in their Aadhaar cards, sans any mistake) in the respective fields and hit 'Submit'. The linking will be confirmed after they receive a verification from UIDAI.

The email says that one must ensure that the date of birth and gender in PAN and Aadhaar are exactly the same. A validation process compares the names given in the Aadhaar and PAN. "In a rare case where Aadhaar name is completely different from name in PAN, then the linking will fail and taxpayer will be prompted to change the name in either Aadhaar or in PAN database," said the email.

Citing complaints made by tax payers that their names were not matching in both systems, the I-T Department said the process of linking PAN with Aadhaar has been made easier.

Aadhaar can also be linked to PAN by quoting Aadhaar details in PAN application form for new PAN allotment or by quoting Aadhaar in change request form used for reprint of PAN card.

PAN-Aadhaar linking via SMS

The I-T department has also launched an SMS-based facility for taxpayers to link their Aadhaar with Permanent Account Numbers.

As per an advertisement by the tax department, the 12-digit Aadhaar number issued by the Unique Identification Authority of India (UIDAI) is based on the demographic and biometric information of a person. It can be linked with PAN by sending an SMS to 567678 or 56161.