'Ailing' PSU banks get Cabinet nod for consolidation

Consolidated bad loans or non-performing assets of these banks stand at Rs 8-11 lakh crore.

Mumbai: The Union Cabinet led by Prime Minister Narendra Modi on Wednesday gave an in-principle nod to consolidation of banks. India's banking sector is bleeding as it faces a non-performing assets or bad loans worth Rs 6 lakh crore.

The NPAs figure further goes up with addition of bad loans of private sector banks. Cumulative estimate puts bad loans figure at Rs 10-11 lakh crore after penciling in private sector loans.

From April 1 this year, country's largest public sector lender State Bank of India merged its five sister banks with itself. It also subsumed Bharatiya Mahila Bank with itself, thus evolving into a single, larger, consolidate bank. After unification, SBI stands at number 45 among world's top 50 banks.

The government aims to cut the large number of banks currently operational in country and bring it down to 12. The consolidation exercise will pass through various clearing steps before it finally sees the light of the day. However, experts had put forward their 'negative' opinion, as they say two or more weak banks coming together will not do any good to India's ailing banking sector.

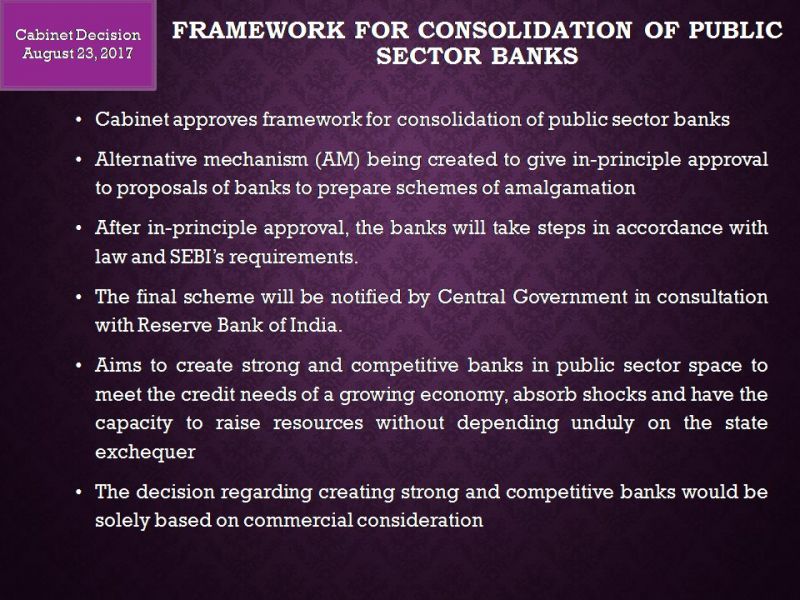

Following are key features of the Cabinet decision that the Modi-led panel took on Wednesday public sector banks:

1- Framework of consolidation of public sector banks.

2- Alternative mechanism for in-principle approval so as to enable banks prepare for merger of state banking entities.

3- Banks will require Sebi's nod too to go ahead with merger exercise.

4- Central government will issue final schemes in consultation with the RBI.

5- Consolidation aims to make room for more credit availability in the growing economy.

6- Decision to merge banks will be based solely on commercial purposes.