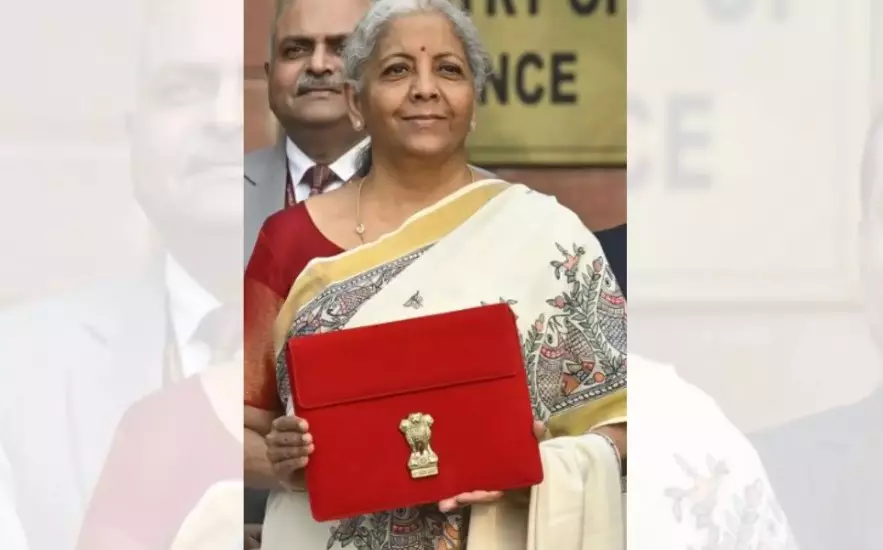

New income tax bill will be introduced next week: Nirmala Sitharaman

Reaffirming the commitment of the tax department entailing ‘trust first and scrutinise later’, Union finance minister Nirmala Sitharaman on Saturday said that she would be introducing the new income tax (I-T) bill next week.

New Delhi: Reaffirming the commitment of the tax department entailing ‘trust first and scrutinise later’, Union finance minister Nirmala Sitharaman on Saturday said that she would be introducing the new income tax (I-T) bill next week. “It was announced in the last July budget and we had committed to bring in the next six month. The government would be detailing the changes and reforms to indirect taxes and direct taxes later,” she said while briefing the reporters here.

The finance minister said that the government would replace the six-decade old income tax act of 1961the new I-T bill in Parliament next week. “The new bill will be clear and direct in text with close to half of the present law, in terms of both chapters and words. It will be simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation,” she said while addressing a post-budget press conference.

“The government has implemented several taxpayer reforms in the last 10 years and the new income-tax bill will be next week. Thereafter, the new income tax bill will go to the Standing Committee of Parliament. I hope it (the Bill) will get passed without much difficulty,” the finance minister added.

Sitharaman had in July last year announced a comprehensive review of the Income-tax Act 1961 to be completed within 6 months. Following that, the CBDT had set up an internal committee to oversee the review and make the Act concise, clear, and easy to understand, which will reduce disputes, litigation, and provide greater tax certainty to taxpayers. Also, 22 specialised sub-committees have been established to review the various aspects of the Income Tax Act.

As per the government data, over 6,500 stakeholder suggestions have been received, and the review has been completed. The Income Tax Act 1961, which deals with imposition of direct taxes — personal income tax, corporate tax, securities transaction tax, besides gift and wealth tax, currently has about 298 sections and 23 chapters.