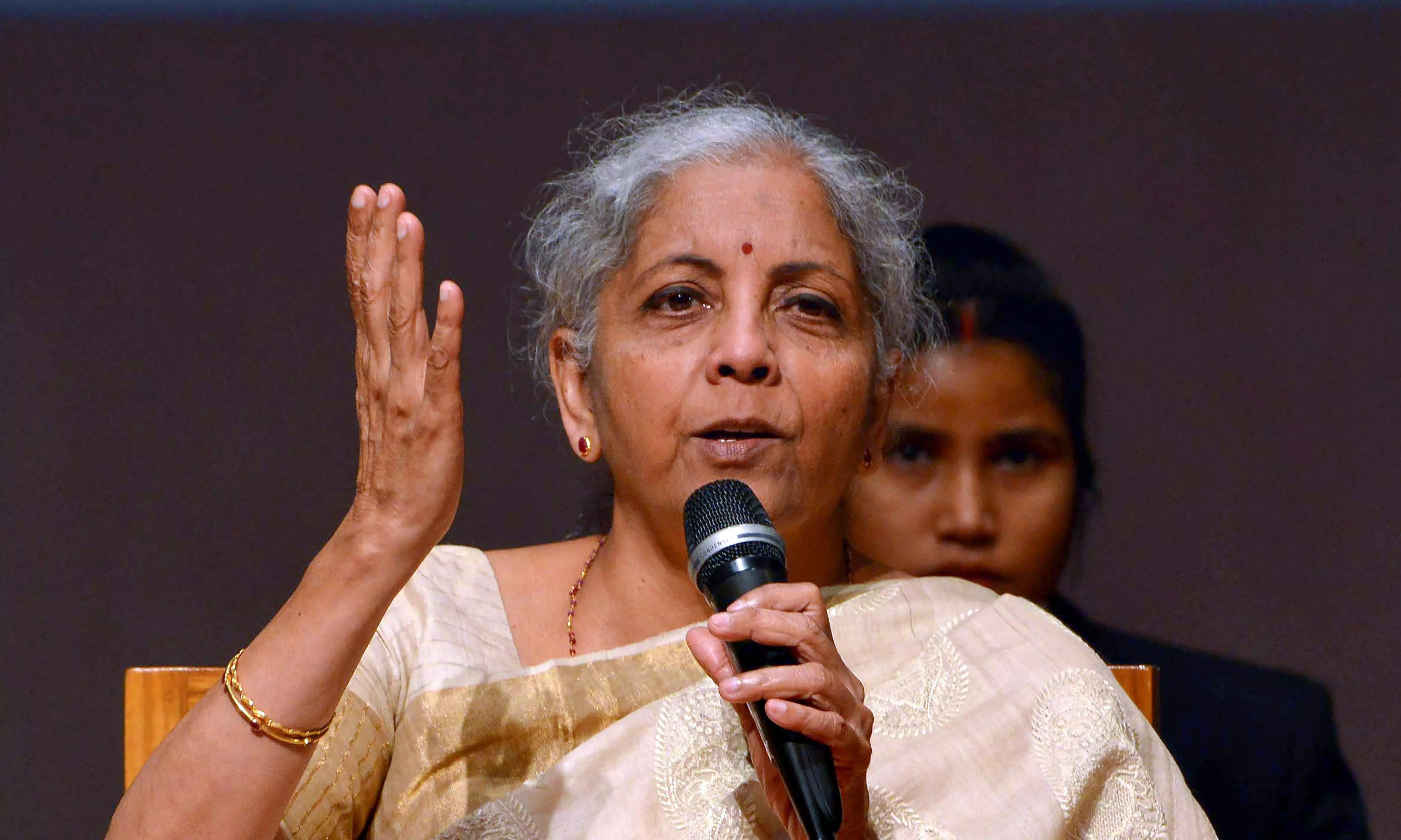

Nirmala Sitharaman launches National Pension System Vatsalya scheme for minors

New Delhi: In a significant development aimed at strengthening long-term financial security and fostering early savings habits, Union Minister for Finance and Corporate Affairs, Nirmala Sitharaman, has launched the National Pension System Vatsalya (NPS Vatsalya) scheme.

Announced in the Union Budget 2024-25 on July 23, 2024, this innovative pension scheme is designed exclusively for minors, marking a significant advancement in financial planning and setting a new standard for prudent financial management from a young age.

This saving-cum-pension scheme, regulated and administered by the Pension Fund Regulatory Authority of India (PFRDA), marks a significant advancement in the government’s efforts to enhance financial planning and security across generations.

By focusing on intergenerational equity, NPS Vatsalya not only aims to secure the future of its young subscribers but also underscores the importance of nurturing a culture of savings from an early age.

Under the NPS Vatsalya scheme, parents can invest a minimum of Rs.1,000 per month with no upper limit, thereby fostering a habit of disciplined savings for their children. The scheme is designed to be operated by parents until the child reaches 18, at which point the account transitions into the child’s name.

Upon reaching adulthood, the account can be seamlessly converted into a regular NPS account or another non-NPS scheme. With the promise of substantial wealth accumulation through the power of compounding, NPS Vatsalya envisions providing a dignified and secure financial future for its subscribers, aligning with the government’s commitment to comprehensive financial well-being.

Account Creation and Management

Under the NPS Vatsalya scheme, all minor citizens up to the age of 18 are eligible to open an account. The account is opened in the name of the minor and managed by their guardian until the child reaches adulthood, ensuring that the minor remains the sole beneficiary throughout the process.

The account can be created through registered Points of Presence (PoPs) with the Pension Fund Regulatory and Development Authority (PFRDA). These PoPs include major banks, India Post, and pension funds, with both online and physical modes available for account setup.

For those seeking an online option, the NPS Trust’s eNPS platform provides a convenient and secure method for account creation and management. A complete list of registered PoPs can be found on the PFRDA website.