DC Edit | Jobs likely focus of next Budget

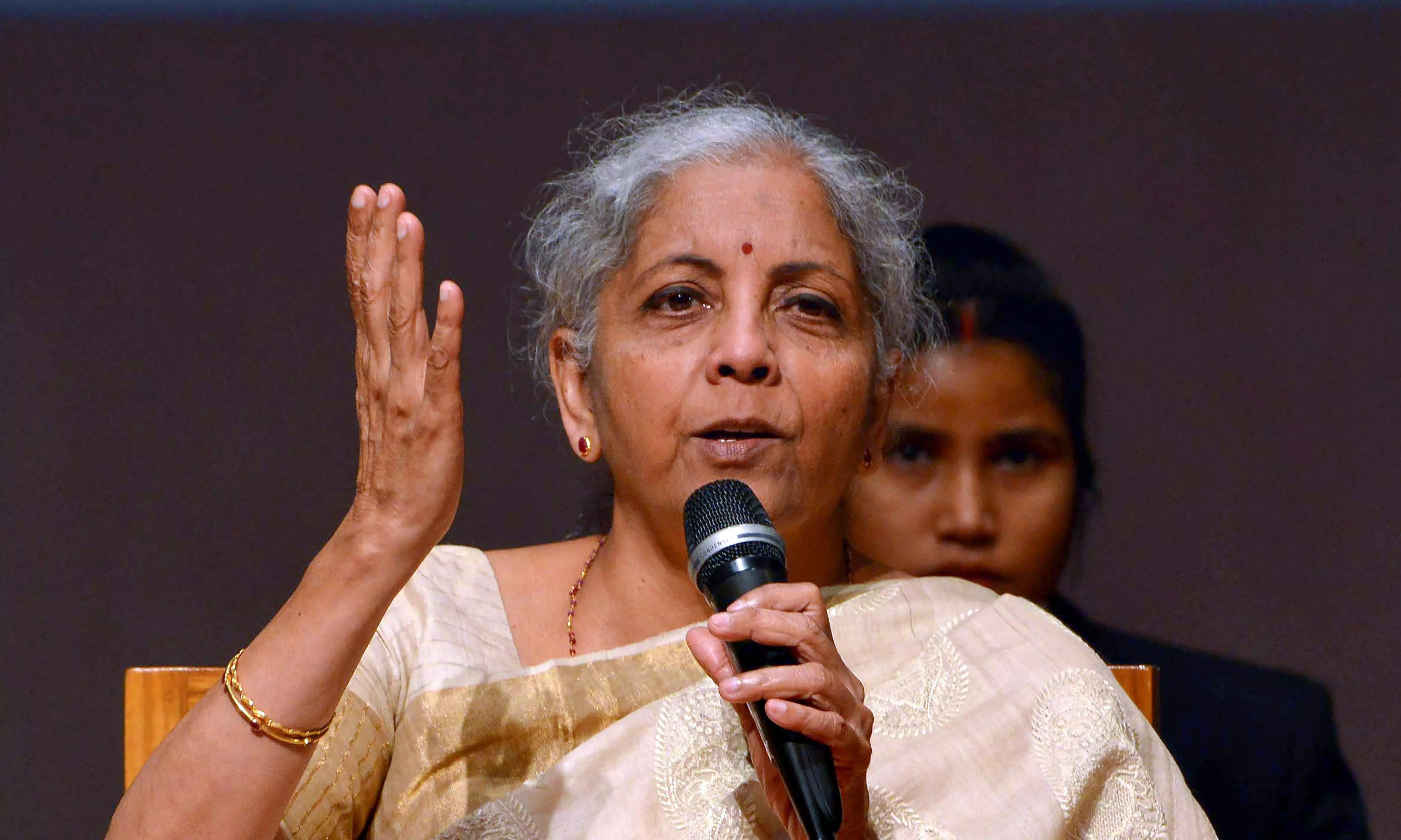

Finance minister Nirmala Sitharaman would present her sixth Union Budget on July 23, becoming only the third person to achieve this feat after P. Chidambaram and Morarji Desai.

She would be the only finance minister to hold this office for six years without a break. While this Budget would set a milestone in the career of Ms Sitharaman, it is also expected to be widely different from the Budgets presented by the Narendra Modi government in the last 10 years.

Though Prime Minister Narendra Modi wants to brush aside the impact of the 2024 Lok Sabha elections, most economists expect the 2024 Budget would be markedly different.

The election results have shown fault lines in the BJP vote bank, especially among jobless youth. The Budget, therefore, is expected to focus on generating jobs, investing in skill development and expanding the social security net.

The Telugu Desam, whose support is crucial for the BJP to be in power, could exert pressure on handing out large sums of money — close to Rs 1,00,000 crore by some estimates ��� to build the new state capital for Andhra Pradesh at Amaravati.

Similarly, the BJP could be under pressure from its leaders from Maharashtra to allocate some funds ahead of the Assembly elections in October 2024. The Janata Dal (United) could expect some financial support to Bihar, one of the laggard states in the country.

Going by the President’s speech, the Indian industry expects a big push for agro-based industries, dairy and fishery-based industries. As part of its agenda for green energy, the government could support non-fossil fuel vehicles, solar power for houses, metro rail and bullet trains.

One of the biggest demands of the middle class, considered to be the biggest supporter of the BJP, has always been an increase in income tax concessions.

However, it is unlikely that Ms Sitharaman would have enough space to balance between the aspiration of the middle classes and the hard reality of fiscal deficit. She could at best increase the income tax threshold under the new tax regime, which does not enjoy the benefits of various tax saving avenues.