Can Google Assistant be trusted to send money?

The upcoming addition to Google Assistant looks promising. Will it work in a country like India?

At this year’s I/O conference, Google announced an arsenal of improvements to its entire software ecosystem. Among all the eye-catching AR and VR stuff, one of the improvements was the addition of the ability to send money to your contacts by Google Assistant. Now, this may seem like a very obvious upgrade that was looming on the horizon for some time. But there’s more to it than meets the eye.

In wake of the recent demonetisation undertaken by the government of India, the Indian smartphone consumer got forced to adapt the digital way of making payments for regular transactions. After it phased out, most of the people returned back to the old cash payment system. But, it showed the people that their big blingy smartphones can be of more help in times of need rather than uploading pictures of their legs or puppies on social media. Payment portals like Paytm, Freecharge and others have come into prominence and are gaining recognition amongst the general masses of the country. The Indian government also launched their UPI-based payment app called BHIM.

For these apps, the process is fairly simple. You open the app, add some money from your bank account to one of these digital wallets and then conduct transactions by validating the receiver through a QR code or telephone number. As for the BHIM app, you can eliminate the middleman-esque wallet and directly control your bank account(s) from the app.

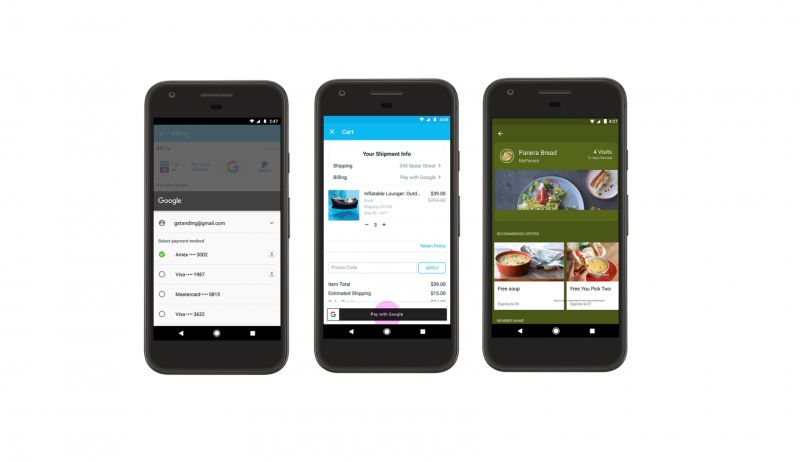

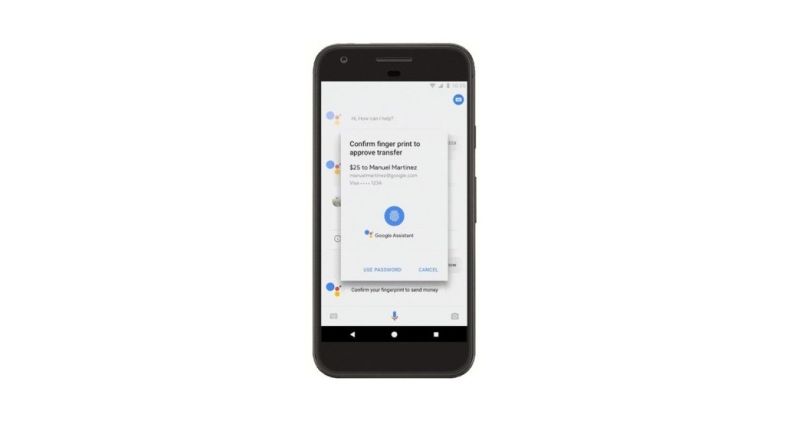

The system that is to be implemented in Google’s Assistant is fairly different. You have to register your card details with your Google account initially. Then, you can make your online transactions through the Assistant by simple using your fingerprint for authentication of the transaction. This system can also be linked with Android Pay. You can simply ask Assistant on your Android phone to pay money to one of your acquaintances by simply commanding it through your voice and fingerprint

Both the payment options make the cash bills look pre-historic and cumbersome. However, there lies a big problem with the digital payment service – will a country like India adopt it without any concern?

When you have paper cash, you know that you are in complete possession of your earnings. You are in charge of keeping it as you like, without letting anyone else (apart from the government and the bank) know a single thing about it. It is direct. When it comes to the digital payment system, you have to trust a third-party entity completely on the basis of their terms and conditions document (which nobody bothers to peek at). You have to let them know about your bank account number, your IFSC code and your card details. For Google’s account based system, you may even have to let them know your access codes as well in some way or the other.

All of this adds to the worries when you read newspapers carrying articles of massive ransomware attacks. IT giants may say that suck kinds of attacks only happen on older, unsupported platforms and newer systems have advanced layers of security built into them. That may sound good on paper but the known fact that a piece of software can get hacked by anyone anytime through some kind of loopholes in the security firewall, which the developer may have overlooked.

In the case of Google’s system, putting your bank account saving details in your Google account doesn’t sound very safe. Gmail accounts are prone to hacking by an interested layman through guessing passwords on computers. Though smartphones are comparatively safer with biometric protection, the accounts can still be hacked by some expert coder, like someone who designed the Wanna Cry ransomware.

Knowing all this terrifies the common man who’s earnings make him someone in the society. He wouldn’t like to get his savings account hacked by someone sitting thousands of kilometres away in a restaurant. Consider the Indian mentality and it becomes harder for him to adapt the newer system. We took so much time to ditch the Ambassador car in favour of modern efficient hatchbacks. We still back superstitions to this date. We still prefer old technology to their latest iteration. We can only ditch something when we are assured of the new being absolutely dependable. We aren’t early adopters like western world.

And that is where the question mark comes on Google’s payment system. It is certainly easier and faster to use than digital wallets. It is more modern and in line with the technology we use. But is it completely safe? Linking a bank account worth life’s savings with open source software running on hackable devices with basic levels of security doesn’t seem promising. Can a country like India, where there’s abundance of old technology operating the backbone of the economy, trust in this new technology?

It will take some time to adapt to technologies like this. Also, Google will have to ensure the security of important details through some kind of failsafe method. The government has to update to newer IT infrastructure and ensure stricter firewalls between consumer end software and financial institution software. With all that in place, we can peacefully say,” OK Google, send some money to my brother.”